Working Papers

Asset (and Data) Managers [PDF] [SSRN] Job Market Paper ⬝ Recipient of the INQUIRE Europe 2025 Research Prize

⬝ WFA Brattle Group Ph.D. Candidate Award

⬝ INVERCO Best Paper in Asset Management at 32nd Finance Forum

⬝ Best Ph.D. Student Paper at the 7th FutFinInfo Conference

⬝ FMARC Best Ph.D. Student Paper

➢ Main Presentations: 7th Future of Financial Information Conference, WFA, USI Lugano,

32nd Finance Forum, SGF Conference, Annual Financial Markets and Liquidity Conference,

FMARC Doctoral Tutorial, Trans-Atlantic Doctoral Conference, HEC Paris PhD Workshop,

SFI Research Days

➢ Abstract [+]

This paper studies whether asset management companies use customer data to attract capital. Exploiting information from their websites' codes, I track when fund managers begin collecting and analyzing data on their potential customers using tools like Google Analytics or A/B testing. I show that funds adopting such technologies attract 1.5% higher annual flows and charge higher fees, despite no improvement in performance. These results are concentrated in retail share classes and decline with competition as more rival funds adopt similar tools. At the fund-family level, adopters expand their product offerings, and new funds focus more on retail-oriented themes. Within existing funds, I find evidence of changes in prospectus content and greater sales efforts rather than product differentiation. Overall, data technologies allow managers to raise more capital and charge higher fees, without passing these monetary gains on to investors. Technological innovation in asset management extends beyond portfolio allocation decisions, and it affects how funds attract and retain capital.

2. Financial Intermediaries and Demand for Duration [SSRN] [PDF]

with Andrea Tamoni and Alberto Plazzi

This version: October 2025

➢ Main Presentations: MFA, 4th LTI@UniTO/Bank of Italy Workshop on Long-Term Investors,

7th World Symposium on Investment Research, SFI Research Days, 1st IFEA Conference,

SGF Conference, EUROFIDAI Paris December Finance Meeting*

➢ Abstract [+]

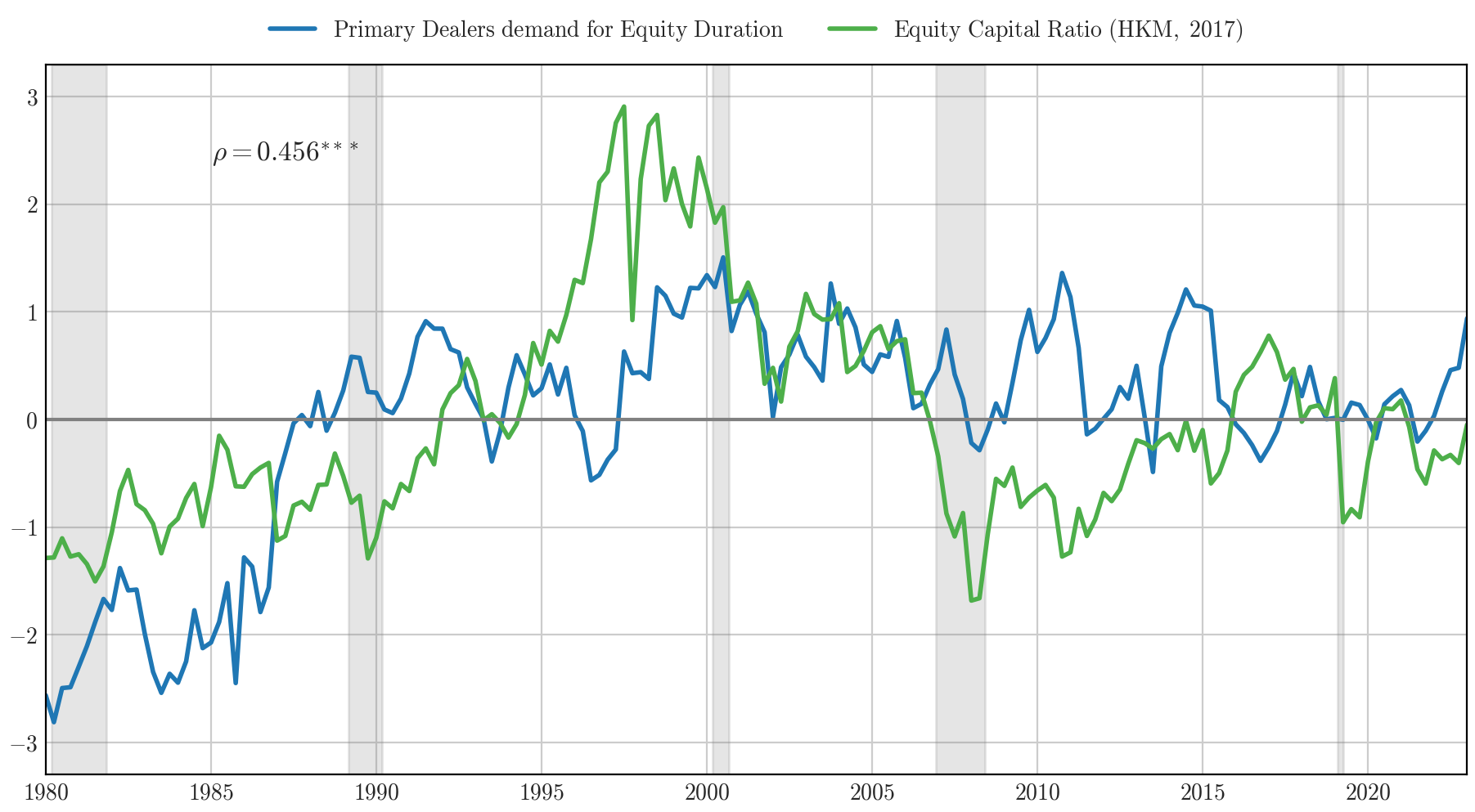

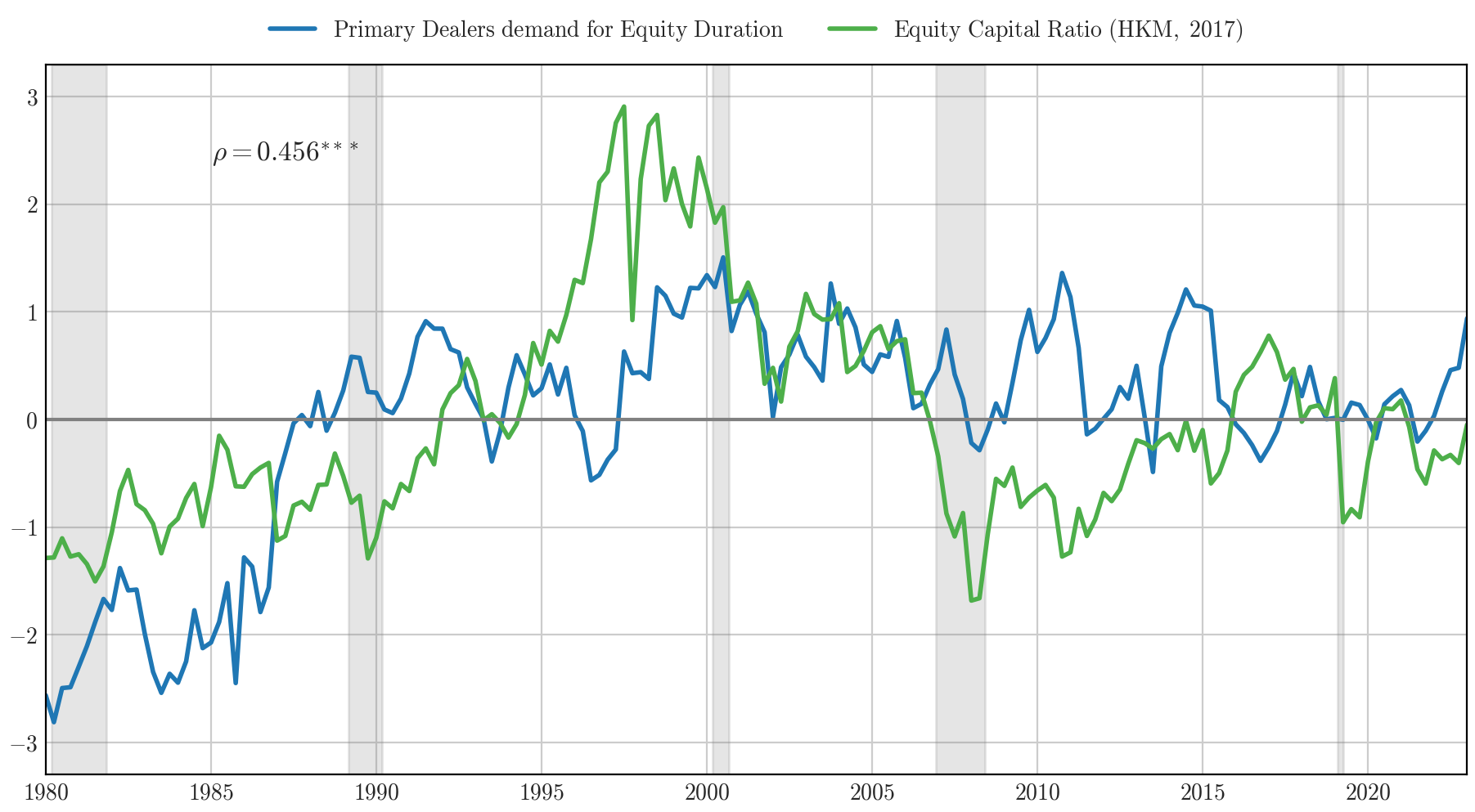

Stocks with long-term cash flows earn lower expected returns because they hedge fluctuations in investment opportunities. We study the role of financial institutions in shaping this duration premium using equity holdings of primary dealers, pension funds, banks, and insurance companies. We find that intermediaries’ demand for equity duration varies systematically with their risk-bearing capacity. In the time series, institutions reduce their demand for long-duration claims and increase their exposure to reinvestment risk when aggregate capital ratios are low. Such a result extends cross-sectionally: better-capitalized and better-performing institutions tilt their portfolios more strongly toward long-duration stocks than their constrained peers. These patterns align with an ICAPM framework in which hedging demand declines with risk aversion. Counterfactual exercises show that shifts in intermediaries’ preferences generate monotonic changes in expected returns across duration deciles, with especially large effects when demand shocks operate at the holding-company level.

3. Are New Technologies Replacing the Information Produced by Financial Markets?

with Laurent Frésard [PDF]

This version: November 2025

➢ Abstract [+]

Using the staggered adoption of data technologies providing firms with novel insights about their customers, we show that their investment becomes significantly less sensitive to non-fundamental stock price movements after adoption. The effect is consistent with data technologies improving managers' internal information about future demand, thereby reducing their reliance on stock market signals. This ''replacement effect'' is robust to alternative explanations and reverses under data-privacy restrictions. Our findings suggest that the diffusion of data technologies weakens the informational role of stock prices in guiding real investment decisions.